Power of Social Network

Power of Social Network

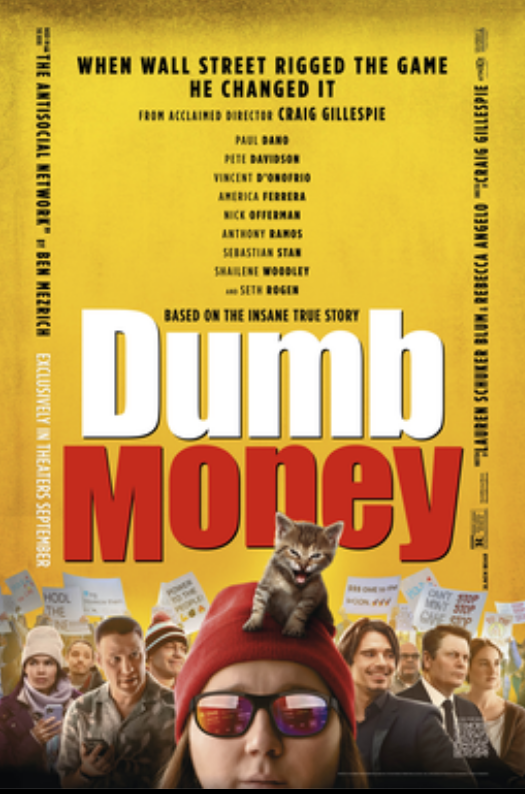

Recently I watched a nice low key movie on Netflix. I don't know if any one of you remember the Gamestop (GME) shortsqueeze in 2021. For the un-initiated below are the official definitions:

In finance, being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. This is the opposite of a more conventional "long" position, where the investor will profit if the value of the asset rises

Typically for 'average' 'retail' investors/traders, in order to short a stock, meaning to sell it without owning it, you must borrow the shares. Typically you borrow it from your online broker. Although this may sound complicated for the average Joe, but it is not. You just click a button, just like the 'buy' button, you click the 'short sell' button, and everything happens internally within your trading platform of your online brokerage. In the back-end, you broker borrows it from someone who own it (actually not, likely they borrow it from a dark pool, but that's a different topic altogether). Point is, you don't feel a thing and you are suddenly short 100 shares of GME as in this movie or 100 shares of NVDA today (don't do it, I am Long NVDA for last 5 years!!, you will lose all your money). Oh, now you know where most of my wealth came from:)

When lot of people short a stock of a company, its short interest rises. So short interest:

Short interest is the number of shares that have been sold short and remain outstanding. Traders typically sell a security short if they anticipate that price will decline by borrowing shares of stock. The investor then sells these borrowed shares to buyers willing to pay the market price. Short interest is often an indicator of current market sentiment. An increase in short interest often signals that investors have become more bearish, while a decrease in short interest signals that they have become more bullish.

In this story of dumb money (real life). In 2021 a lot of large financial houses, or hedge funds went heavily short on a number of stocks during Covid lockdown: GME, AMC, BBBY. These short-selling thesis were strong. These companies were already struggling before Covid, but during lockdown, theese were Shopping Mall foot-trafic based companies, you can guess what happened to them. As there were no foot-traffic in the Malls, there were no revenue for these companies. So fundamentally there were doomed and ready to go bankrupt! Selling the shares short to zero, seems like a very valid thesis!

But then wallstreetbets reditt group happened. And it triggered the mother of all short squeeze!

In the stock market, a short squeeze is a rapid increase in the price of a stock owing primarily to an excess of short selling of a stock rather than underlying fundamentals. A short squeeze occurs when demand has increased relative to supply because short sellers have to buy stock to cover their short positions.

The movie features a 'virtual nobody' (my favorite term, its a praise, as I am a honest supporter of virtual nobodies, honestly, no sarcasm here!) named Roaring Kitty, or Keith Gill in real life, who started an YouTube channel about financial market and was a frequest user of the sub-reditt wallstreetbets; who started a community movement of buying (long position) GME stock. Fairly quickly he started a massive following due to his honest and effective communication of his personal trades. What followed is a stuff for history books and was featured in the movie. I do not want to spoil it for you. But it is all real, you should watch it!

Real Life Congressional Testimony

Conressional Testimoney as shown in the movie

This movie was a pleasant surprise.

I am glad you liked it!

Oh wow, they actually made the movie!? I thought that was a joke. I followed this story for a while, read WSB and enjoyed their antics and lingo [Tendies!], and even bought GME stocks as well. And like a lot of those that post in WSB, my GME stock is still red haha. But thanks for sharing this. I'll go watch the movie to reminisce and have some fun.

Market timing is critical.

Movie is well made and entertaining!

was some crazy times over on reddit lol

It was a big deal! It essentially changed how the markets work for a short period

I watched this on the plane on the way to the UK a few weeks ago and really enjoyed it. It was amazing how they all held onto it - some of those people should have sold and improved their lives! Aaaaagh...

You know I have been trading since I was 16 years old, now a old man of 48 (I feel much older than I really am, trust me). During my time in the financial market I personally made every single one of those mistakes multiple times:)

But also made our family financially free!

I don't know if there is a lesson learned there, but market is an amazing teacher. I am fortunate to have such a good teacher.

Financial freedom is an enviable state to be in. I guess I need to exercise the risk muscle a bit more.

Education. Usually self-education is the best path forward. If I remember you are an educator :)

Well remembered Az!

I never understood what was taking place at the time. It wasn't until later that I finally understood what was happening during that time period. It was pretty funny watching all the big money guys freaking out a bit.

Yes it was a revolution essentially.

Marketing isn't that easy because you fail and you pass but if you learn from the market I believe it's way more easy

after seeing the Wolf of Wall Street 2 days back I'm always in the loon for movies that have this tag.

Would definitely check this out, thanks for sharing.

😂 what an irony! The investor profiting when the asset reduces in value!? That must be unimaginable fiction. But I like the story.🥰

In our real world we invest and wait for the asset to appreciate.

It was nice coming across you post @azircon. 😍 I'll be stopping by more often.

@tipu curate

Upvoted 👌 (Mana: 41/51) Liquid rewards.

Great movie, I really enjoyed it, plus the music and soundtrack kept the story moving along.

Nice story with great lessons to learn.