Anarchist Investor Weekly - Economy Has to Crash - Top 5 Investment Movies - Do More With Less - Kinesis Money - Survive the Next Financial Crisis

Anarchist Investor Weekly

Your weekly review of the Anarchist Investor Newsletter

The Economy Has to Crash Before Real Inflation Happens

A short diatribe.

THE ANARCHIST INVESTOR

MAY 13, 2024

I’ve written and talked about the Federal Reserve’s difficulties causing inflation in the past. Several Fed Governors lamented that try as they might, even with near 0 interest rates, they couldn’t get inflation up to 2%. It all has to do with the velocity of money. How much money is in the system is just one data point in the inflation picture. It also needs to change hands rapidly to unleash that inflation. The economy that has been built over the past 40 years is slow and lumbering. It all needs to crash before the Government can inflate the debt away.

Inflating the Debt Away

It is the intent of the central bankers throughout the western world to inflate their large sovereign debt piles away. Here’s the catch, everything needs to fall apart first.

The bad wood needs to be ripped out. The Economy is functioning inefficiently from 4 decades of mal investment. Low interest rates have caused spending in industries that offers low Return on Investment. You can’t get dynamic growth from building business models that prize only marginal increases in productivity. All of these zombie companies need to be cleared out.

Unfortunately, that means a lot of folks who work for these companies will lose their jobs. It also means many of them have been trained with skill sets that may be unneeded in the next phase of the economic model. From the 40’s to the 80’s the US Government inflated its’ debt from World War II away. However, there was a lot of pain that culminated in the supply shocks and rampant inflation of the 1970’s. Thus began the most recent economic phase we have been in from the 1980’s to the 2020’s. That phase was characterized by artificially low inflation rates.

The US and countries around the world are about to look a little bit more like the 1940’s to 1950’s. History doesn’t repeat, but it certainly rhymes.

Keep in mind that the US Government softened the gold standard in 1933 and fully decoupled from the Gold standard in 1973. This phase of inflating the debt away may be much quicker and more violent. Real inflation is on the horizon.

- Get out of variable rate debt (it will bankrupt you)

- Have a job that can keep up with inflation (sales, brokerage, commissions, etc)

- Have a side hustle (this can salsify #2 and become you’re full-time gig)

- Invest in assets that will grow with inflation like real estate, gold and silver

My Top 5 Investment Movies

In No Particular Order

THE ANARCHIST INVESTOR

MAY 14, 2024

The Big Short

“In 2006-2007 a group of investors bet against the United States mortgage market. In their research, they discover how flawed and corrupt the market is.” - IMDB

This movie has been the one that I have watched the most ever since it came out in 2015. It’s part dramatization, part documentary. The investment personalities in the film are folks I wanted to be like. They had (or at least are portrayed as having) integrity and a certain level of ethics. Granted they’re involved in the world of robber barons and white collar criminals that is Wall Street. However, they possessed either intense attention to detail and/or gut feelings that allowed them to identify what everyone else couldn’t. They called bullshit on the consensus that everything was just fine in the economy/markets. For that, they were rewarded with riches.

Favorite Scene: In a recreation of an actual event in this story, Mark Baum (the portrayal of Steve Eisman) debates Bill Miller. Miller is a Wall Street perma bull who holds huge stakes in firms like the now defunct Bear Stearns. He makes a very basic case for why investment banks don’t fail (unless caught up in illegal activity…like they don’t do illegal things every day). Baum (Eisman) gives a speech about how fraud is rampant in society and he wished we had been better than this. During the speech, Miller literally loses tens of millions as Bear Stearns stock collapses. Baum (Eisman) concludes simply by saying, “BOOM!”

The Pursuit of Happyness

“A struggling salesman takes custody of his son as he's poised to begin a life-changing professional career.” - IMDB

Another movie based on a real story, this one focuses on the life of Chris Gardener who goes from being homeless to a hugely successful stock broker in San Francisco. It’s a story of perseverance that even if it’s only 10% true to life is incredible. Often when I think about how my life is going, I remember this story and it makes me understand that things aren’t so bad and that there’s always a way to succeed.

Favorite Scene: Gardener has an interview to become an unpaid intern and he has just gotten out of city lock up for unpaid parking tickets. He had been painting his apartment he’s about to get evicted from just prior to the arrest. In a tee shirt and paint covered pants, Chris takes the interview and delivers an incredible line. One of the interviewers asks him something to the effect of ‘what would you say if I gave a spot to someone who showed up to his interview without a jacket or tie’? Gardener answers, “He must’ve been wearing a great pair of pants.”

Too Big to Fail

“Chronicles the financial meltdown of 2008 and centers on Treasury Secretary Henry Paulson.” - IMDB

The film came out shortly after the Great Financial Crisis and tells the opposite side of the story from what is portrayed in The Big Short. To a certain extent it positively portrays the ‘heroic’ efforts of the government stooges that engineered the sales of failed banks and bailouts to prop up the house of cards that was the world economy in 2007 and 2008 that they themselves had a hand in creating. There’s just enough criticism of the real-life people portrayed in the film to get an understanding of how business is done in the US. Around 2011 I was still seeking answers for what really happened. There was also some remaining faith that the system was saved by these folks. I’m glad my naivety was remedied shortly after this film was released.

Favorite Quote: “There is not a bank in the world that has enough money in its vault to pay its depositors. It's all built on trust.” Henry “Hank” Paulson

Boiler Room

“A college dropout, attempting to live up to his father's high standards, gets a job as a broker for a suburban investment firm which puts him on the fast track to success. But the job might not be as legitimate as it first appeared to be.” - IMDB

One phrase, ‘Act as If’. It’s a monologue delivered by Ben Affleck. It’s the updated version of fake it until you make it. As a young professional in the finance industry, I recognized that sales was the holy grail. It’s the way you make your way up the ladder. While this story focuses on a chop shop (fraudulent stock brokerage), there is an inspiring depiction of learning how to close sales. It also provides a sobering look at the insanity that is the brokerage world when there is no integrity…or maturity.

Favorite Scene: Giovanni Ribisi’s character receives a telemarketing call from a local newspaper. He initially says no and the telemarketer is set to hang up without any pushback. Ribisi stops him from hanging up and gives him a pep talk to sell him and close him. The caller makes a great pitch finally and Ribisi applauds the pitch. When the caller asks if Ribisi will now subscribe, he says “No, I already get the Times” and hangs up.

Don’t Miss Your Chance At a Paid Subscription!!!

I’m giving away a yearly paid subscription valued at $99 to 4 free subscribers on June 3, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe: https://anarchistinvestor.substack.com

OR BETTER YET…Become a paid subscriber today and:

📚 Access to the full Anarchist Investor Archive Including Paid Only Posts

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

Wall Street

“An impatient young stockbroker is willing to do anything to get to the top, including trading on illegal inside information taken through a ruthless, greedy corporate raider who takes the youth under his wing.” - IMDB

The classic story of a young broker trying to acquire a whale investor as a client but ends up becoming the robber baron’s prized pupil. Michael Douglas’ role as Gordon Gekko is iconic. He is the embodiment of the evil side of greed and self interest. His monologue about ‘Greed is Good’ is a thing to behold. At the end of the day, he black pills the share holders of a large paper company and sells them on his Greed being righteous while the executives’ Greed is immoral. Chef’s kiss to the bitter irony.

Favorite Scene: Greed is Good

Wild Card: A Good Year

“A British investment broker inherits his uncle's chateau and vineyard in Provence, where he spent much of his childhood. He discovers a new laid-back lifestyle as he tries to renovate the estate to be sold.” - IMDB

What I love about this film is the juxtaposition of life in the French countryside to the high speed life of high finance in London. For a piece of my life I wanted the latter. I now realize I want the former. While not well reviewed, this is one of my favorite films because of the scenery, the love story, and the inclusion of the mystery of a local fine red wine.

Favorite Scene: Russel Crowe’s character is offered a once-in-a-lifetime opportunity to become a partner at his financial firm. He has just returned from France after having a perspective-altering experience for a few days. He is given the choice of a large check or an equity piece in the business. There is a Van Gogh hanging on the wall and his boss tells him it’s a reproduction. The real one he keeps in a safe. Russell Crowe’s character asks if he ever goes to see it. It’s a beautiful way of asking about why you own things. If it’s just to own them, what’s the point?

Do More With Less

What needs to be done to "fix" the economy

THE ANARCHIST INVESTOR

MAY 15, 2024

This is going to be a short diatribe but very needed in the present moment. Many folks will tell you that the present course of US government deficit spending is unsustainable. They will also tell you that Federal Reserve monetary policy is to blame for inflation throughout the past 100 years. They aren’t wrong. However, there is a realization that most folks refuse to let seep in. Perhaps the last 40 years has been unsustainable. This includes their own standard of living.

Our Lives Need to Get Tougher

It’s been too easy. Comedians talk about it all the time now. Times have been so good that we get stacks of as many napkins as we want or free soda refills at the fast food place. We can use our smartphone to get someone to deliver us food, groceries, medicine, and pretty much anything we want within a couple minutes. Amazon deliveries take less than a day in many cases now. Our government has created transfer payment programs that appear to have unlimited ability to take in less than they pay out. Corporate welfare programs balloon every year without any sense of slowing or retracting. Wars cost Trillions and it doesn’t matter if we win or not, simply that we’re there “fighting for freedom.” Things get more expensive every year and we just ask for a raise or hop to a new firm that’s willing to pay up for the same productivity. These ways of life have become baked into the American dream but perhaps they are just that, a dream.

The 1940’s to 1980’s marked a time when the excesses of the early 1900’s and the war-time spending of WW1 and WW2 had to be paid back. It required savings, frugality, and investments in boring things that had a huge long-term ROI. The built up savings of that period was then leveraged to borrow against in the 1980’s to 2020’s. Keeping interest rates low to fuel huge debt issuance was the norm most of us have become accustomed to. Debt was so easy to access that I had no job as a college freshman and was issued over $5,000 in credit cards with just a signature. I even got some free tee shirts and concert tickets! This isn’t responsible behavior. It’s largesse unlike has ever been seen in this country. That binge on cheap money created a bill that now needs to be paid.

The 2020’s will mark a line in the sand. The next 40 years will be boring. And they need to be. We have to make them that way. We need to take a lesson from the depression era teachings of our grand parents and learn from their example. However, there it’s very difficult and will be viewed as painful to many. The government will try and fight against it. They will fail and it will expand and prolong the pain. The light at the end of the tunnel is we can see what has happened, what is to come, and what we need to do to prepare.

“Stop living up here, and start living down here.”

I Bought Gold & Silver Crypto

An early review of Kinesis Money

THE ANARCHIST INVESTOR

MAY 16, 2024

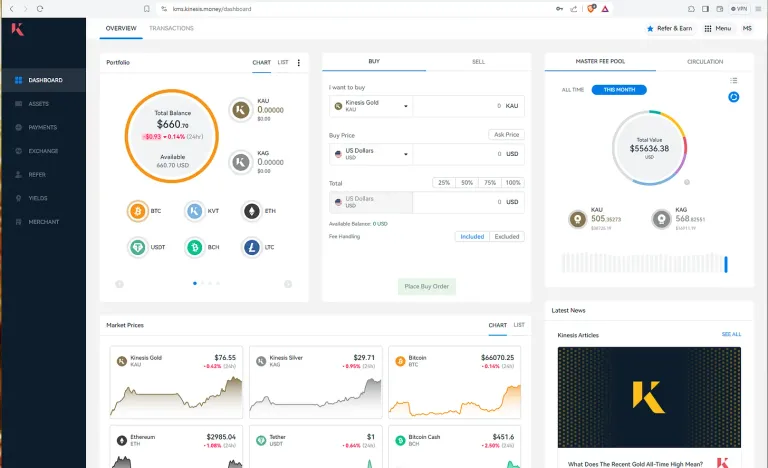

Since I really started to dig into what is money and how that translates into what I want to hold my assets in, a lot of options have been made available to me. Physical gold and silver, crypto like Bitcoin, fiat currency, etc. At the end of the day, the track record of physical Gold & Silver can’t be argued with. However, it does lack some of the qualities that would turn those metals into easily transactable money. I believe Kinesis Money is one of a couple companies addressing those very qualities.

Turn Fake Money into Real Money

I wanted to begin this story with an action I and others could take to improve their investment portfolios. That is why I cleared out the change container (checking for actual silver money) and redeemed it at the bank. I then used those funds to purchase Bitcoin to transfer into my Kinesis Money wallet. All in total, there was $356.50 in that pile of change. A nice start. I also added a little additional Bitcoin as I purchased it through Swan Bitcoin and Kinesis facilitates holding and transacting in larger market cap crypto like Bitcoin, Ethereum, Litecoin, Bitcoin Cash, etc.

Digital Money

We obviously live in an increasingly digital world. Physical gold and silver are fantastic, as long as you’re geospatially close enough to someone else who also like to deal in those metals and has the product or service you’re looking for. However, when it comes to the world of digital payments, not many options exist outside of the fiat currency system. Bitcoin and crypto are the main solutions at present and I’ve detailed several of the trappings of those in past articles. However, they do present good alternatives. However, what if you could combine hard assets like physical gold and silver with a frictionless an encrypted digital payment system?

That’s where Kinesis is trying to bridge the gap. In short, Kinesis mints its Gold (KAU) and Silver (KAG) crypto only when physical gold or silver is added to their custodial vaults. This means that for every coin of KAU or KAG there is physical gold and silver backing them up. This also means that you can use your gold and silver in ways that weren’t possible just a couple years ago. I also like the feature that this platform allows you to do some forex (currency) diversification. I can purchase Swiss Francs or Singapore Dollars as well as a handful of other fiat currencies if I desire.

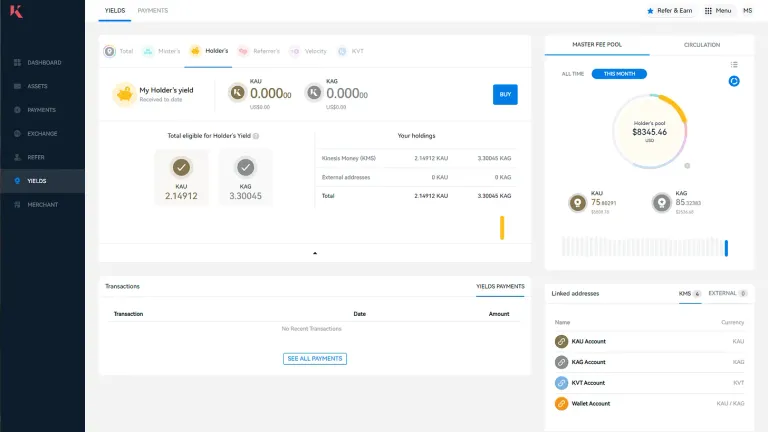

Yield

One of the biggest hang ups that gold and silver detractors have is the inability for gold and silver to earn yield. I have already talked about Monetary Metals in prior posts and how gold and silver leases can generate returns on precious metals beyond just their spot price increasing. Kinesis takes this feature to a whole other level. There are several ways in which Kinesis rewards holders of KAU and KAG with yield.

Holding

Just for holding the coins you receive a portion of the yield pool. The yield pool is generated via fees on transactions, gold and silver leasing, and a couple other avenues.

Minting

There is also an option to mint new KAU and KAG by depositing physical metals with Kinesis. This means that the coins minted from those deposits lock you into receiving yield on those very coins forever. There is a pretty hefty minimum to get started minting so keep that in mind.

Referring

When you refer others to onboard with Kinesis, you are entitled to a small portion of the yield/transaction fees that those referrals generate. This follows them as long as they continue to work with Kinesis.

Payments

Kinesis can issue you a virtual debit card (not available in the US just yet) that affords you the ability to make payments online or using your smartphone app and it will convert KAU, KAG, or even other crypto into fiat currency in real time to make those purchases. As you use your account for purchases, Kinesis generates some fee income and a portion of that fee income is returned to users of the payment system as yield. This is kind of analogous to points or cash back when using a credit or debit card. I also believe the payment system is international (anywhere Visa or Mastercard can be used) so the account can follow you if you are an international traveler.

Kinesis Velocity Token (KVT)

KVT from what I gather is the staking token for Kinesis. In essence, by purchasing at least one full token (worth $2,000) at present, you’re helping to keep the platform operating by investing in it. You are basically an equity holder of Kinesis Money and returns generated are returned to KVT holders in the form of a yield.

In short, you get a piece of the action as opposed to traditional financial firms that profit off of your deposits and transactions while returning you crumbs or even nothing as a thank you.

The Setup Process

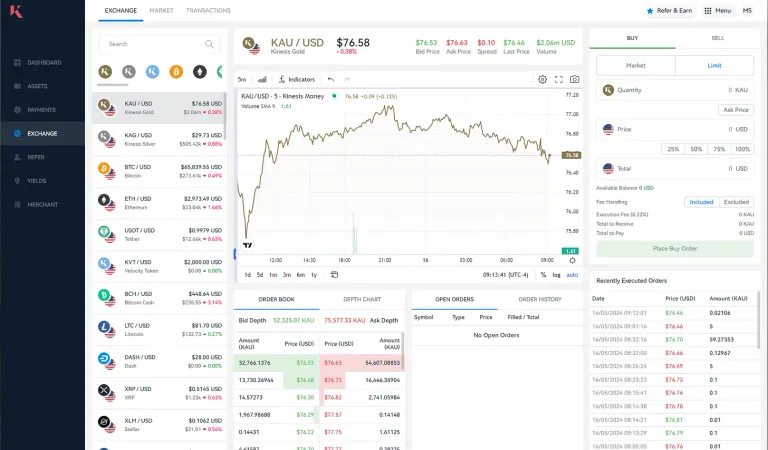

I wouldn’t say this was difficult. However, if you have never used crypto before, it can be a little bit of a learning curve. The biggest hurdle in my experience was funding the account. It was easy enough for me as a crypto holder and user. But if you are unfamiliar or don’t hold crypto, it can be difficult to fund your account. I made my initial deposit in Bitcoin after purchasing it through Swan. This can be done with a number of crypto’s. The other main way to fund the account is via deposit into a Bank of America account. My advice if you don’t have a means to fund your account with crypto is to get in touch with an account executive at Kinesis. In fact, I was assigned one and he reached out within 24 hours of opening my account on my own. It’s an amazing resource to have an actual human to help you and answer questions.

The KYC (Know Your Customer) operation was also annoying. No, there is not a non-KYC option here so there obviously isn’t anonymity in this system. The verification application was a bit finnicky but I was able to manage a decent picture of my passport that completed the verification process.

The exchange operates smoothly. This is another aspect of crypto or trading that the lay person might not be familiar with. Again, you can rely on your account executive if you need a walk through or have any transactions you’re not able to setup.

Conclusion

The user experience so far has been pretty smooth. A couple hiccups with the funding and ID verification but nothing major. The biggest drawback is the virtual debit card and smart phone app not being available in the US just yet. I’m certain they’re working to rectify that in the near term. I’ll have more to report on when those features are live as well as my experience in moving funds between money and currency in the account.

If this is a platform you’re interested in and want to try it out, please use my referral code here to get setup: https://kms.kinesis.money/signup/matthews281

Survive the Next Financial Crisis (Preview)

A peak at the week ahead

THE ANARCHIST INVESTOR

MAY 17, 2024

This is a little bit of a tease. I wanted to give everyone a peak at the next 5 articles I am going to be writing. I will be building a survival plan for economic crisis. No, this is not a doomsday prepper thread. The plan will be somewhat thorough though. The articles will focus on the various areas of life that need to be prioritized and some sample techniques on how to keep them functioning for you and your family/loved ones during a financial crisis. They are prioritized how I would prioritize them. You might put them in a different order or perhaps even add or subtract one of your own. The key here is the exercise of doing the planning. The prioritized list of life areas are as follows:

- Physical Health

- Mental Health

- Basic Expenses

- Basic Investment

- Grow Your Wealth

What’s the old adage… ‘Plan for the worst, hope for the best’? That’s what we’re doing here. Battening down the hatches and making sure that the worst case scenario doesn’t sink us. And perhaps we can even come out the other end stronger and more successful.

It’s going to be part thought experiment and part practical investment advice. I’m looking forward to taking this journey with y’all.

Affiliate Links

Purchase Gold & Silver, earn yield, and spend using Kinesis Money https://kms.kinesis.money/signup/matthews281

Get $10 in free Bitcoin and start stacking today with Swan Bitcoin: https://www.swanbitcoin.com/anarchistinvestor

Get $50 in credit toward Fractional Real Estate investment with Lofty: https://lofty.ai/refer?grsf=afyjpd

Automate your Gold & Silver Purchases with Vaulted:

https://vaulted.blbvux.net/g1EGKX

Save/Make Money on your Cell Phone Plan with Helium MOBILE:

https://my.hellohelium.com/ref/2FN2CHL

Anarchist Investor Links

Anarchist Investor on Substack: https://anarchistinvestor.substack.com

Anarchist Investor on Spotify: https://open.spotify.com/show/5bPTSl9UcLuDOlki25iBjU?go=1&sp_cid=195eae3f83bf1083418e06af7cb8af8f&utm_source=embed_player_p&utm_medium=desktop

Anarchist Investor on Rumble: https://rumble.com/c/c-6154833

Anarchist Investor on YouTube: https://www.youtube.com/channel/UChC2sQ_wL6esPg8e3_NsPDA

Matt_Archy on X: https://twitter.com/Matt_Archy

Matt’s Personal FB: https://www.facebook.com/matthew.struck.37

Matt’s Personal LinkedIn: https://www.linkedin.com/in/matthewstruck/

Matt-Archy on HIVE: https://peakd.com/@matt-archy

Matt-Archy on Vimm.tv: https://www.vimm.tv/c/matt-archy

Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation